Investing in multifamily real estate is a process and over time, you learn how to gauge multifamily market cycles. When should you pick up a property to fix and flip? When should you renovate and sell? When should you refinance and hold on to a property, if needed?

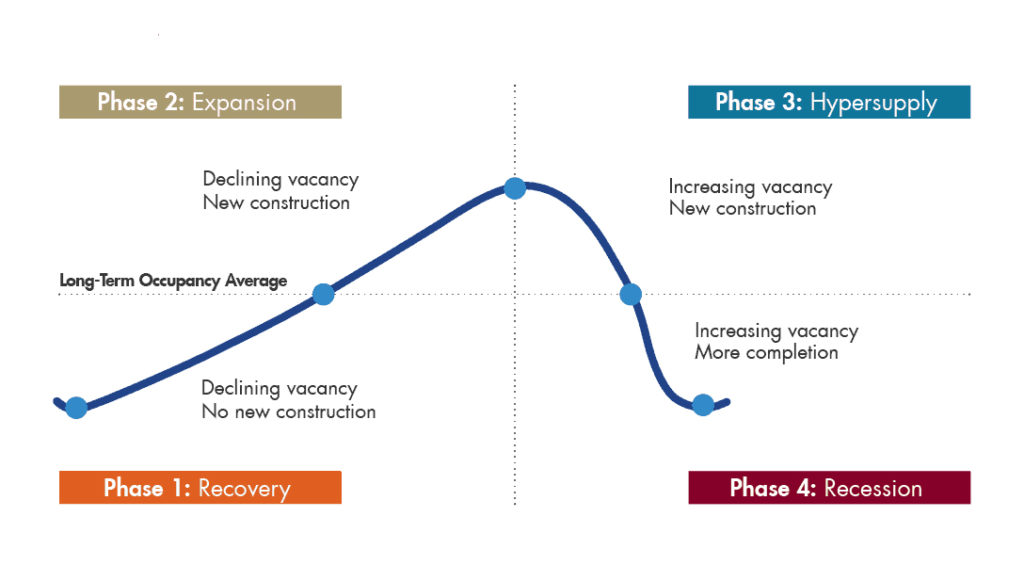

It’s imperative that you become familiar with real estate cycles in your existing and target multifamily markets. Is the market moving out of recession and into recovery, or is it moving from expansion into hypersupply? It’s possible to invest successfully across all phases of the market cycle, but better understanding of multifamily market cycles can help you make more effective investment decisions. This knowledge helps ensure that you don’t make the wrong investment at the wrong time.

Phase One: Recovery

During the recovery phase, there is no new construction. Vacancy rates in the area are slowly declining: the average multifamily property has a steady stream of renters but may have trouble keeping all of the units full. There are several signs your property is in a recovery market:

There is negative or flat rent growth. Rent growth remains at or equal to inflation rates, rather than increasing substantially.

Companies have just started hiring. Companies in the area are starting to slowly bring in new employees, which will in turn create a higher demand for housing. There’s solid employment growth in the area, which means that people moving into the area won’t have too much trouble finding jobs–and those jobs may also bring new people into the area.

In the recovery phase, it’s a cash buyer’s heaven. Sellers are getting positioned to sell. This is a great time for strategic value-add for experienced operators, especially if you’re able to hold the property until the expansion period. Cash is king during this stage, because it may be tough to get financing. You may have high carrying costs in the interim due to high vacancies, but you may also be able to buy more quickly and easily, and for a better deal than you would during other periods.

Phase Two: Expansion

During the expansion phase, the area is expanding and growing. You’ll see several key signs:

Declining vacancy rates. There are fewer open apartments and other multifamily rentals in the area. Many apartment buildings may find it easy to keep renters in their apartments.

Rent increases. The market is reaching peak efficiency for owners. Rising rents are designed to support new construction and redevelopment of existing properties. Other owners may decide this is the ideal time to make those key renovations, and there’s an upward pressure on rents as new construction pops up.

Unemployment in the area declines. Local employers have more openings, and fewer people in the area struggle with unemployment. People who lose their jobs have little trouble stepping into a new open position.

The expansion phase is both a seller’s market and a buyer’s market: sellers will benefit from selling at higher rates than the recovery period, while buyers will appreciate being able to snap up multifamily dwellings in a market where they are more likely to rent. This is also an excellent time for value-add strategies that will help increase the value of your properties and raise your rents. During the expansion phase, buyers are still banking on rental growth, which means they may overpay for an asset; however, stable properties and a stable community makes this an ideal time for development.

Phase Three: Hypersupply

The next phase in the multifamily market cycle is hypersupply: a period when the market is oversupplied with rental properties. New construction is still feasible, but the area is moving towards overbuilt. Look for these signs that your market is entering hypersupply:

Vacancies are increasing. It may be harder to find renters for properties, especially those with higher rents or less desirable areas. Properties will remain vacant longer.

There is declining rent growth. The price of rent may continue to grow, but it won’t grow as fast as it did in the other phases.

New construction isn’t being absorbed. Instead of new buildings filling quickly, they may take longer to absorb into the market. New properties may sit empty longer. The supply is increasing, making it a renter’s market, rather than a landlord’s.

During the hypersupply period, it’s a seller’s market. Many people are looking to get out before the previous high values of the properties begin to fall. During this phase, savvy landlords start thinking hard about tenant retention and how to keep their existing tenants, rather than focusing on how to bring in new ones.

Phase Four: Recession

The market for rental properties is saturated, with supply outweighing demand. Are you worried that you may be looking at a property in an area during a recession period? These signposts in multifamily market cycles will put you on alert:

Construction stops. New product is still being delivered as former projects are finished, but no new construction is started in the area.

Vacancies increase. In many cases, they may fall below the long-term, 30-year average because of the high rate of available properties. Renters have their choice of properties, and they may look into new options if they aren’t satisfied with their current lease.

There is negative rent growth. Rental rates grow slower than the current inflation rate. Interest rates, on the other hand, are on their way up.

The recession market is a buyer’s market, especially for distressed properties. This makes it an excellent time for people with cash reserves to renovate, reposition, and hold properties until the expansion phase.

Research Multifamily Market Cycles

IRR’s Viewpoint is an annual publication that shows the market cycle positions of major US cities for each asset class dating back to 1995. We encourage you to explore historical multifamily market cycles with this valuable tool. The Real Estate Market Cycle Report, compiled by Glenn Mueller, PhD, provides analysis of MSAs across 5 property types. Scroll to the bottom of the page to find their quarterly analysis.

Of course, nothing beats actually getting out in the streets and doing your own research. We’ll probably be saying this until the cows come home.

Do you need help defining multifamily market cycles or choosing the ideal market for your next multifamily real estate purchase? Contact us today to learn more about how we can help with your investment journey.

Latest posts by Theresa Bradley-Banta (see all)

- Multifamily Common Areas Maintenance & Management Tips - March 31, 2020

- 8 Tenant Gift Ideas That Will Boost Your Bottom Line - November 11, 2019

- Need a Package Delivery System at Your Multifamily Rental Property? - October 28, 2019