by Theresa Bradley-Banta

“How do I find the best real estate markets to invest in?”

It’s one of the most often asked questions I receive.

When I wrote my article Best Cities To Buy Apartment Buildings I believe some readers expected me to tell them exactly which cities they should invest in.

I won’t do that because:

- There are very few cities where apartment investing is a “bad” idea.

- It’s best to buy locally when possible—especially if you are a new investor. Long distance property management presents special challenges.

- Multifamily investors need to continually research and track their investment markets. You must know how to do this.

- Your exit strategies demand that you know where your market is today and where it might be in the near future.

- Your success depends on your personal investment strategy.

What Are Your Strategies Today? Tomorrow?

It’s not likely that your investment plan is to keep a property until you die, leaving it to your heirs. It’s not a bad strategy but it’s unlikely. More likely your strategies will include:

- Refinancing your property after you build equity or your loan terms demand that you refinance.

- Selling your property when the time is right.

Knowing how to test markets is critical to your success—before you buy and after you own your property.

Timing is everything.

The Key Criteria for the Best Multifamily Investing Markets

When you research potential investing markets look for:

- Solid job growth and employment—companies are hiring.

- Improving economy.

- Low unemployment.

- Good to above average population growth and density with high in-migration rates.

- Increasing rental rates.

- Increasing leasing activity without tenant concessions.

- Solid investment neighborhoods.

How do you find this information? You’re in luck!

Checklist for Researching Real Estate Markets

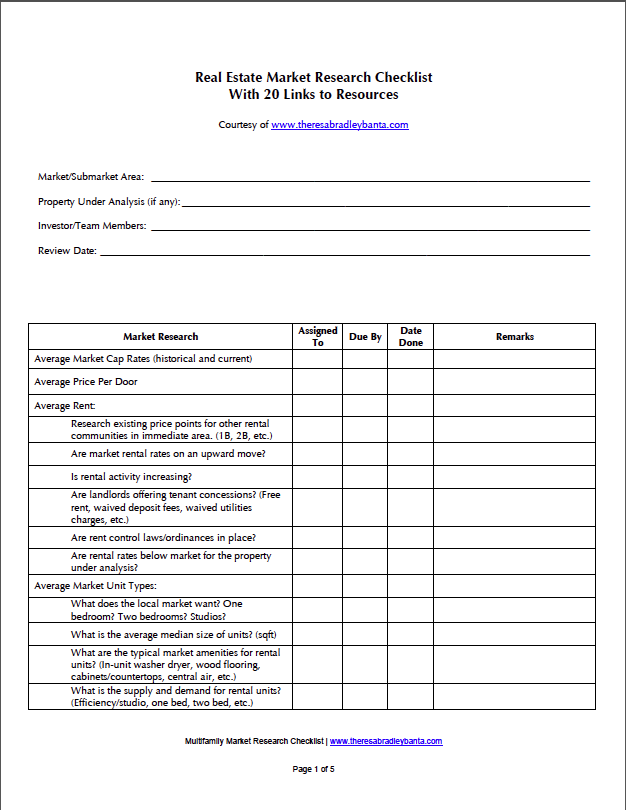

The attached checklist gives you a list of the criteria to apply to each market you study.

And it includes 20 links where you can find the information you’re looking for!

Click on the link and/or the image below to view and download your Checklist for Researching Real Estate Markets. You’ll never look at a real estate market the same way again!

Contact us for a more thorough overview of this checklist and how it might apply to your investment and/or search for new markets. If you really want to know how to research real estate markets this is the stuff you gotta know.

Related Articles:

5 Ways to Quickly Screen Investment Property

How to Study Your Rental Market and Outperform Your Competition

When Is a Good Time to Invest in Apartment Buildings?

Another free download you definitely want to get:

Multifamily Property Checklist: An Owner’s Guide for Operating Apartment Buildings

And some more absolutely free documents:

Free Multifamily Investing Resources

Latest posts by Theresa Bradley-Banta (see all)

- Multifamily Common Areas Maintenance & Management Tips - March 31, 2020

- 8 Tenant Gift Ideas That Will Boost Your Bottom Line - November 11, 2019

- Need a Package Delivery System at Your Multifamily Rental Property? - October 28, 2019

Hi Theresa, thanks for sharing this checklist. There’s actually a report that identified the top 75 cities to invest in and it considered some of the key factors that you mentioned—job growth rate, rental variance rate, vacancy rate. You can find the Rental Property Investor report at http://www.allpropertymanagement.com/rpi-score/2014-q1/

Hi Barbara,

My pleasure! And thanks so much for sharing a link to the RPI Score Report! It’s a fantastic addition to this post.

Best,

Theresa

Thank you for this helpful checklist. I’m just getting started in apartment investing.

Glad you liked the checklist, Shalece. Thanks for taking the time to tell me. I have other checklists you might like at this link. They are free and available to download now. Best wishes, Theresa

Hi Theresa, how can I reach you at? I could not find the form to fill out in the Contact tab in order to connect with you.