by Theresa Bradley-Banta

It’s the most often asked question I receive: How do I know if a deal is a good one or not?

This question is almost impossible to accurately answer without:

- Detailed property operating income and expenses.

- Comprehensive capital expenditure projections.

Today we’re going to talk about expenses.

Expenses as listed in an apartment building offering memorandum (brochure)

Apartment building offering memorandums (sales listing brochures) typically list property operating expenses in general, broad categories almost always like this:

- Insurance.

- Property Management.

- Property Taxes.

- Utilities.

- Repair and Maintenance.

- Administrative.

As I said, fairly broad categories. Until you get your hands on the seller’s historical property operating numbers it’s almost impossible to get an exact understanding of the property.

And it’s your job to get this information.

Your bank or lender will want to see historical cash flow figures for the property going back at least one year, preferably two. So should you.

How do you get them? Simple. Ask for them. Don’t take “no” for an answer. When I analyze deals I ask to see these numbers up front. Before I agree to a showing and before I consider making an offer on an apartment building or any multifamily property.

Hidden expense numbers

The problem with broadly categorized property expenses is that you cannot drill down to specific costs. Without itemized line items you can miss red flags. Expenses can be left out.

For example the simple category “Utilities” will include:

- Gas,

- Electric,

- Water,

- Sewer and,

- Trash (sometimes included in utilities).

Without line item expenses it’s almost impossible to knowledgeably analyze a deal. And to accurately assess potential problems and opportunities.

Operate from a good baseline

When I look at properties in any market I analyze at least five similar deals to the ones I’m interested in purchasing. This gives me a good baseline for typical property expenses.

Such as, if I see an atypically high cost for “Water” I know I need to investigate further. This could be a red flag for serious plumbing issues.

But without a baseline I might completely miss the water bill is high in comparison to similar properties.

Here’s another example. The price for pest control is often included under the “Repair and Maintenance” category. Pest control is a common property operating cost but the number is typically fairly low. An unusually high number could be a red flag for a serious problem such as bed bugs, which can infest an entire property. Bed bugs are becoming more and more common. Even five-star hotels and new Class A apartment buildings can—and do—become infested.

Again, without historical numbers and a baseline to compare expenses to, you might miss noticing an abnormally high pest control number.

Always get a property’s historical operating data

As I’ve already said, always, always use the historical property operating data when analyzing properties. I cannot emphasize this enough.

It is not enough to rely on the broadly categorized expenses presented by a seller or by a commercial broker.

Typical apartment building operating expenses

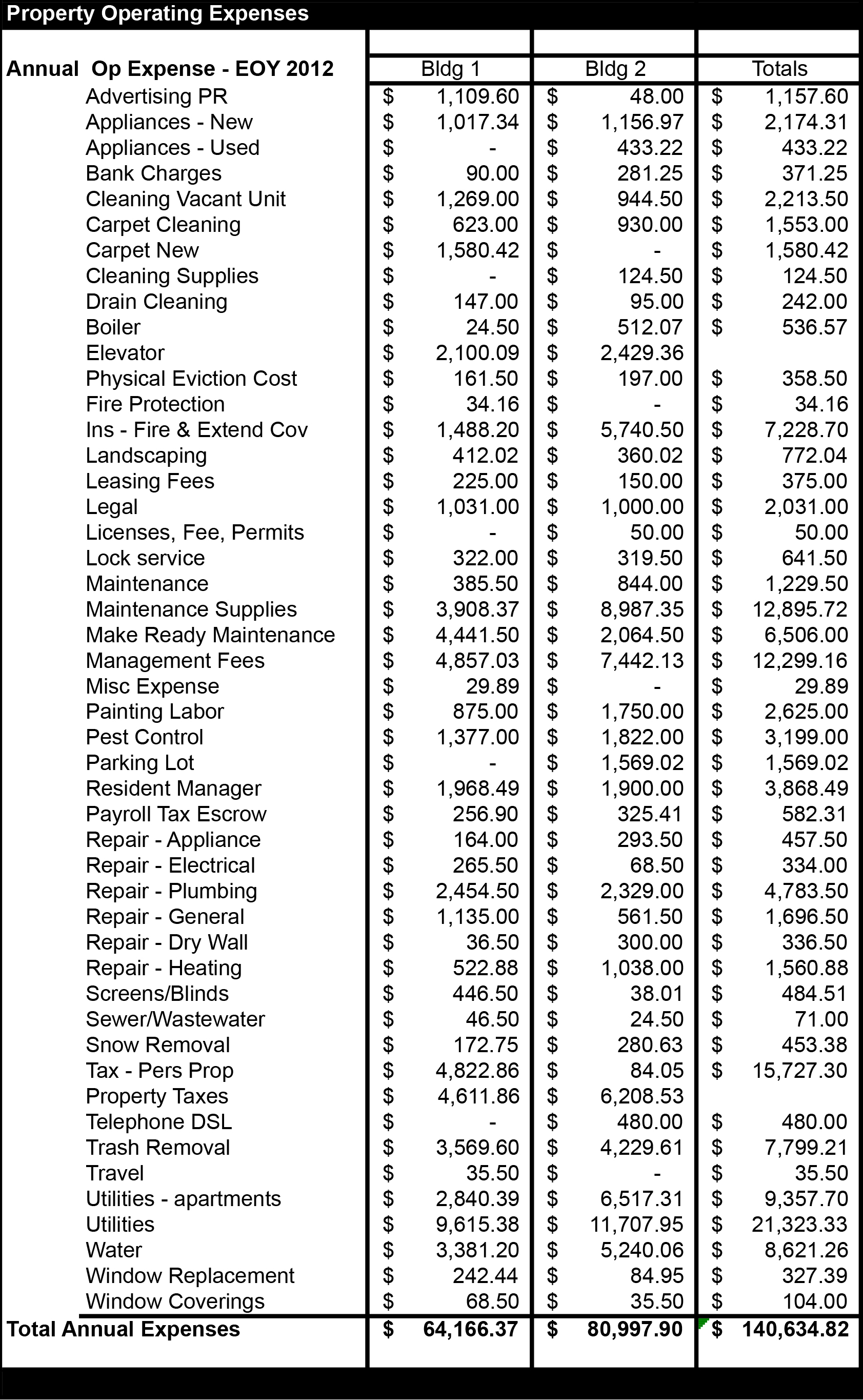

The following spreadsheet will give you a good idea of the number and variety of expenses you will incur as an apartment building owner. This spreadsheet includes two properties totaling 45 units.

Unexpected apartment building operating and renovation expenses

As a new apartment building owner you will incur unexpected expenses. That’s a promise.

It’s almost impossible to foresee every eventuality. You might simply overlook an expense. That happens. But with some practice analyzing deals—as many as you can—you will be become more educated and less likely to miss something.

Until you become proficient with property analysis, work with a multifamily mentor or apartment building owner operator to analyze any deal you are considering making an offer on.

In addition to mentoring programs I offer one-on-one private consulting for specific deal and property analysis. Please visit my Real Estate Mentoring and Consultancy Services page for more information. Or, why wait? Contact me directly with any questions you have.

Related Articles

5 Big Multifamily Deal Analysis Mistakes to Avoid

Creating an Annual Operating Budget for Your Multifamily Property

Multifamily Property Checklist: An Owner’s Guide for Operating Apartment Buildings

***

Latest posts by Theresa Bradley-Banta (see all)

- Multifamily Common Areas Maintenance & Management Tips - March 31, 2020

- 8 Tenant Gift Ideas That Will Boost Your Bottom Line - November 11, 2019

- Need a Package Delivery System at Your Multifamily Rental Property? - October 28, 2019

Great article – thanks for sharing. I can see how getting a baseline for the market is hugely important. That probably wouldn’t have occurred to me without your article.

Best,

Scott

Thanks for reading & commenting Scott! Glad you picked up on the importance of developing a good market baseline. It’s a good habit to get into.

Thank you for sharing your insight on Apartment expenses. I really enjoyed the article and forward to learning more as I invest in multi-Family properties for years to come. Thank you and keep up the excellent work.

Thanks for stopping by Jason. It’s good to connect! Let me know if I can ever help you out!

Theresa

Thank you for pointing out typical apartment building operating expenses! This is a very big help for people wanting to enter the business of renting.

It’s my pleasure! Thank you for taking the time to visit and to leave a comment. Best wishes to you!

Theresa

Theresa – I enjoyed reading all this material – Very Informative !!! Thank you !

Alex G.

Glad you stopped by Alex! Thanks for leaving a comment, I love hearing that I’ve been helpful. All the best to you on your investment journey.

Theresa

I did not see mortgage payment in the list of operating expenses.

Is the mortgage payment considered an ‘operating expense’?

Is only the interest portion of a mortgage an operating expense?

What is the principal portion of the mortgage ‘considered’?

Thanks for your clarification.

Ben,

Debt service goes beneath the NOI (net operating income). Take a look at my article How to Value a Multi-Unit Property and also follow, and read, the linked articles there.

Thanks for stopping by!

Theresa

Great selection of topics.

we manage a 20 unit renovated building in Vicksburg, MS and our ongoing operating and maintenance costs are far more than in you typical example. For instance if we have to replace a washer and dryer in 1 unit (and they need to match), it is as much as your entire year for appliances. Also, how do management cost only come to about $6000 for a year. A manager cannot live on that amount unless they are managing many properties for a salary from a large management company.

Thanks for taking the time to leave a comment.

Actual property expenses will vary by: age; class; style; renter demographics; number of units; management preference; submarket; market cycle; supply and demand; operation policies; etc. All things I’m sure you’ve experienced as an owner-operator of a multifamily property!

No two properties or markets are alike. Your example is appropriate for your property but a new-build Class A apartment building will experience entirely different expenses.

When underwriting a property, it’s imperative to get the actual T12 financials (trailing 12-month property operating data) from the seller/owner. You should never rely on pro forma numbers, never accept broadly categorized expenses or assume anything.

You might enjoy taking a look at the 2016 NAA Survey of Operating Income & Expenses in Rental Apartment Communities. You can also pre-order the NAA 2017 survey at this link.

Thanks again for your comment. Best wishes with your investment.

Theresa

Thanks Theresa for the article ,am practicing auditing in Uganda , Africa but it has given me deep insight of how to categorize operating expenses especially when dealing with apartments,thank you

Thank you. I’m glad to know the article helped! Thank you for your feedback.

Best wishes to you.

Theresa

Do you have any idea what amount of time or money a landlord spends, on average, resolving resident conflicts?

Good question, Kevin. Depends on the location, property size, number of tenants and seriousness of the conflict(s). Best way to avoid issues is to have solid operation policies/procedures and training of staff. You should also have an attorney who is experienced in tenant-landlord disputes.

Thanks for taking the time to visit and comment. Best wishes!

Theresa

HI Theresa,

we are in the process of creating our p&l for an 11 unit apartment we own. should the renovation cost be listed in the p&l or should it not? we capitalized on those costs and placed them on the balance sheet to depreciate it.

Hi Joseph – Capital improvements will appear below NOI. Be sure also to speak with your tax professional to take advantage of the new tax laws. Best wishes!

Theresa

I’d love to know where you can find a Resident Manager and/or property manager for 45 units at that price! Come on …

We didn’t exactly create all this awesome free content over night -lol. We’ll update the post when we get a chance. Thanks for stopping by!

Hello Theresa,

Do the repair and maintenance costs occur monthly (as in hiring a handyman with a monthly salary) or is it per contract (only hire the handyman when there is something to fix).